FNPO Federation of National Postal Organisation, New Delhi

FNPO Federation of National Postal Organisation, New Delhi

FNPO

T-24, ATUL GROVE ROAD

NEW DELHI 110 001

India

ph: 011- 23321378

FLASH NEWS

31/10/2025

Opposing - Objecting the proposed PSS group B RRs.

Dear allToday SG FNPO Sivaji Vasireddy, N Mujawar GS NUPE PIV, MK Sharma GS NUR4 and Sube Singh CS NUR3 Delhi met Member P, CPMG Delhi .

1. Conveyed greetings on retirement of Member P madam Maju Kumar and felicitated.

2. Cadre review committee chairman and CPMG Karnataka Prakash sir submitted the committee report to the directorate.

3. 2023 results of Postman process is in advanced stage and will be released at any time in this November and assured to complete the joining process before 31.12.2025.

4. Asper our request special drive and monitoring cell constituted in every division for opening of service book, ID card, CGHS card etc.

5. CPMG sir agreed for ODP arrangement in the long period to leave spells of postman. Expecting orders/directions soon.

6. Quarters allotment process started .

7. Instructions will be issued soon by CPMG for fixed beats and not change the beats frequently.

SG FNPO

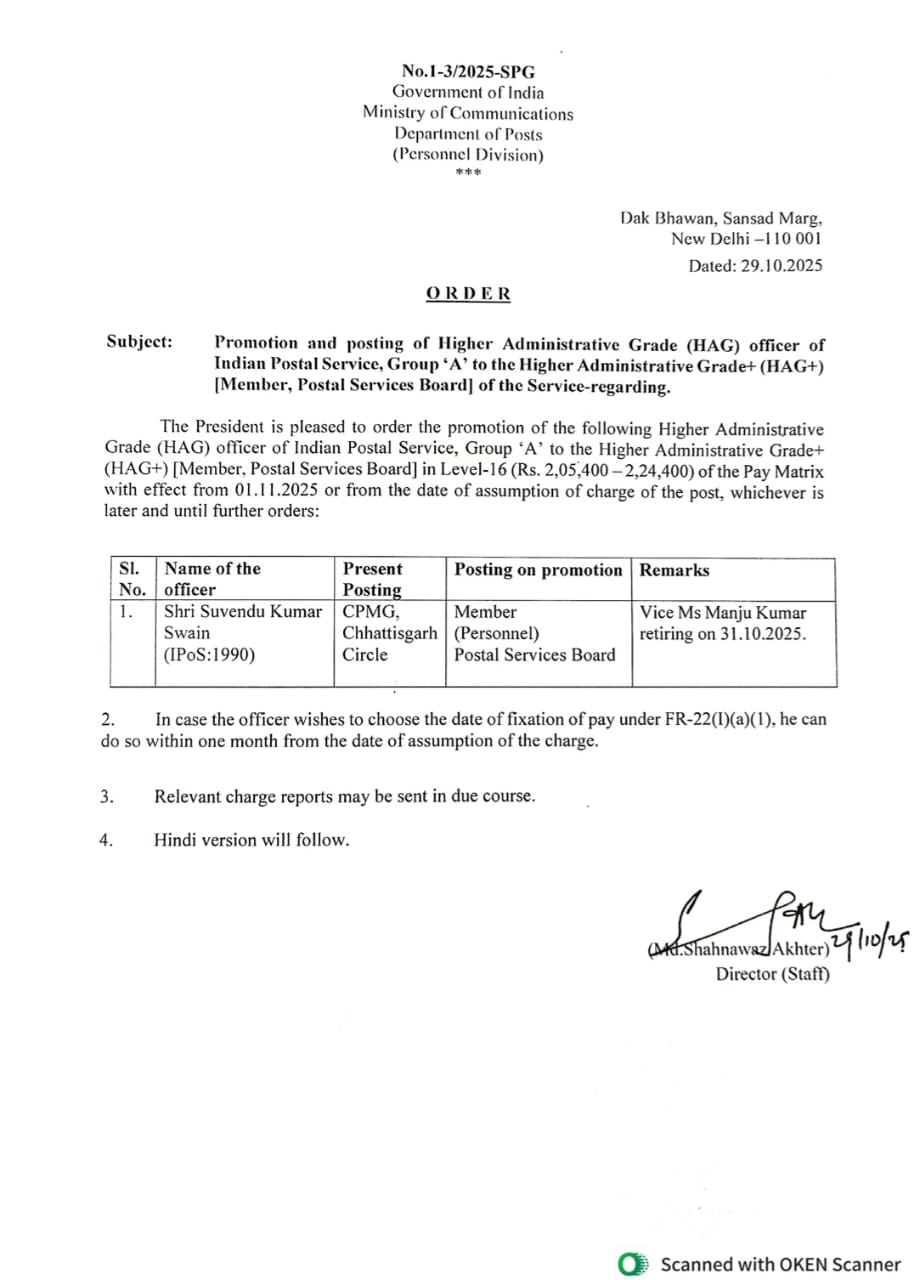

Promotion and postings of Senior Time Scale (STS) officer of Indian Postal Service, Group ‘A’ to Junior Administrative Grade (JAG) of the Service and extension of tenure of regular JAG officer of Indian Postal Service, Group ‘A’.

30/10/2025

Redesignation and revision of duties & responsibilities of Members, Postal service Boardin Department of Posts.

Rationalization of Mail Processing Hubs under Mail and ParceI Optimization Project (MPOP).

Revision of ATM charges.

29/10/2025

Retirement cases — reg. Clarification regarding Enhanced Rate of Family Pension ; Death after.

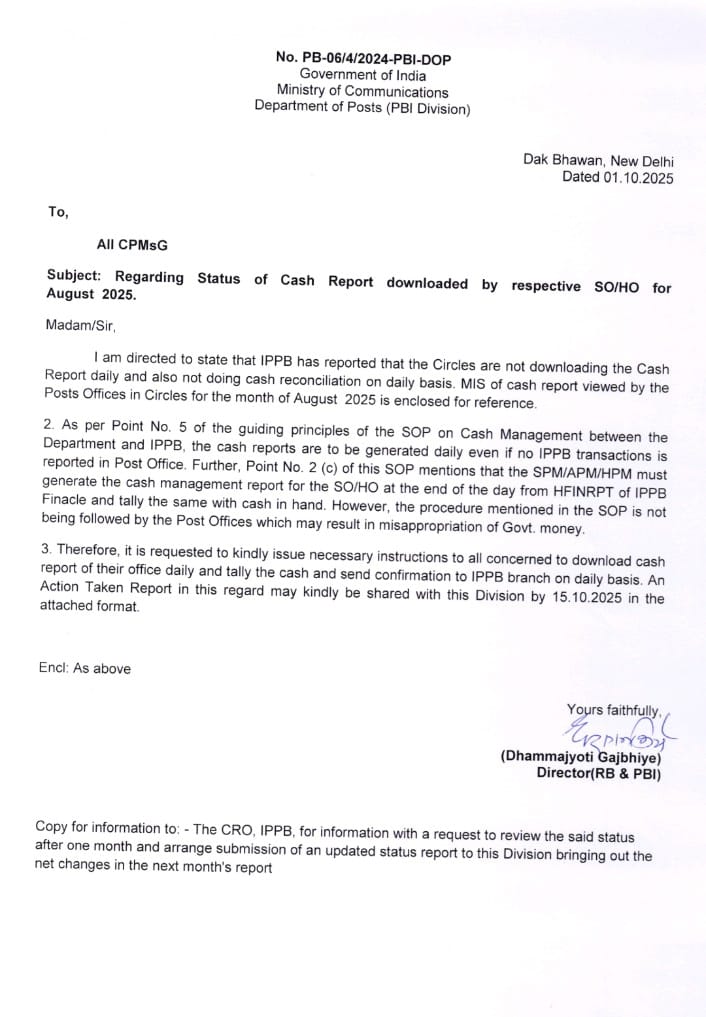

Instructions about submission of Cashbook and CASH Account.

Applicability of reservation of 4% under Rights of Persons with Disabilities Act (RPWD), 2016 for allotment of General Pool Residential Accommodation (GPRA) to person with disability (PwD).

28/10/2025

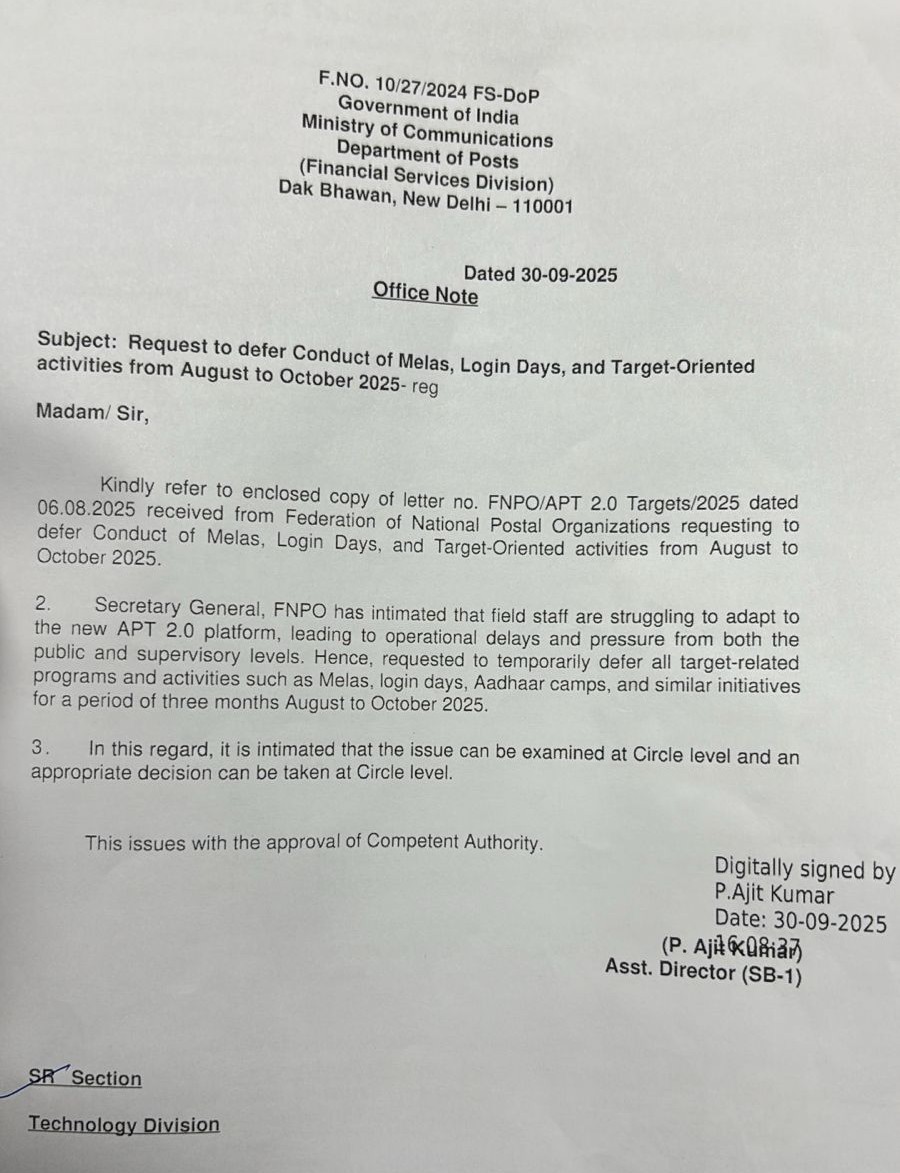

Circulating in Social Media ... Govt authentication is required

Circulating in Social Media ... Govt authentication is required

Settlement of Family Pension between two wives of a Government Servant or Pensioner under Central Civil Services (Pension) Rules, 2021.

Approval of the Competent Authority is hereby conveyed for the transfers/postings of the following ofticers of Poslal Service, Group 'B' cadre.

Dear all,Rule 38 orders will be issued before 15.11.2025.

2023 Delhi circle spl drive results of postman will be released by the end of November and can join in December

For 2022 MTS non joined vacancies 2nd list will be issued soon.

Sivaji Vasireddy

SG FNPO

Request for action against Unauthorized youtube videos on departmental policy and software.

Request for postphonement of IP Exam.

Request request to declare the Results of GroupB Exam held on 04.06.2023.

24/10/2025

Circulation of Clarification on the Properties and Usage of Aadhaar by Unique Identification Authority of lndia (UlDAl).

List of Supporting Document for Aadhaar Enrolment and Update.

23/10/2025

Total of 24,66,314 Central Government employees are enrolled under the NPS. Out of these, 97,094 employees have migrated to the UPS as on 14.10.25. Approximately 3.94% of Central Govt NPS subscribers have migrated to the UPS.

Total of 24,66,314 Central Government employees are enrolled under the NPS. Out of these, 97,094 employees have migrated to the UPS as on 14.10.25. Approximately 3.94% of Central Govt NPS subscribers have migrated to the UPS.

Procedure for joining/ relieving of GDS on transfer under Rule-3 in the new APT 2.0 environment- Standard Operating Procedure (SOP).

Roll out of Dak Sewa Application.

19/10/2025

Sir/Madam,This is to inform that a scheduled maintenance activity is planned at CEPT with an aim to improve the Performance of the system, hence a planned downtime of the APT solution is Scheduled on 19.10.2025 (Sunday) from 07:00 hrs to 21:00 hrs.

During this period, Booking, Bagging and Delivery operations under APT application will be impacted. However, BCP (Business Continuity Plan) will be enabled to facilitate Booking and Bagging operations during the downtime.

It is therefore requested to plan and schedule all Operational activities accordingly to avoid any inconvenience.

This may kindly be brought to the notice of all concerned.

Thanks & Regards

Technology Branch

O/o General Manager

CEPT Bengaluru

17/10/2025

Addendum to the LDCE IP exam 2025 Notification

Addendum to the LDCE IP exam 2025 Notification

Judgement by CAT Eranakulam Kerala on grant of pension under OPS , to officials recruited for the vacancies created before November 2003.

Private Secretary (PS) from now onwards All India Cadre

Private Secretary (PS) from now onwards All India Cadre

10%Spl discount to students for sending applications and other communications by speed post.

16/10/2025

Salary Can't Be Re-Fixed After Superannuation, Hence Recovery Of Excess Payment From Retired Employee Impermissible: P&H HC**************

A Division bench of the Punjab and Haryana High Court comprising Justice Harsimran Singh Sethi and Justice Vikas Suri held that the refixation of salary after an employee's superannuation, leading to recovery of excess payments made without any misrepresentation or fraud by the employee, is impermissible in law. Background Facts The petitioner was a government employee. He retired upon attaining the age of superannuation on 31.07.2016. After his retirement, the Accounts Department of the respondents identified a discrepancy in his pay fixation. The petitioner's pay had been incorrectly fixed at Rs. 11,840/- instead of Rs. 11,170/-. Therefore, the respondents passed an order refixing the petitioner's pay. It was determined that an excess amount of Rs. 1,75,274/- had been paid to him during his service. This amount was recovered from the petitioner's pensionary benefits.

The petitioner challenged the recovery before the Central Administrative Tribunal (CAT). However, the tribunal upheld the respondents' action. But the Tribunal granted the petitioner interest on the delayed release of his pensionary benefits. Aggrieved by the Tribunal's order, the petitioner filed the writ petition. It was submitted by the petitioner that the respondents have committed a grave error by effecting a recovery of Rs. 1,75,274/- after he had already retired from service on 31.07.2016. On the other hand, it was submitted by the respondents-Union of India that a discrepancy was discovered by the Accounts Department regarding the petitioner's pay fixation. It was contended that the petitioner's pay had been wrongly fixed at Rs. 11,840/- instead of Rs. 11,170/-. It was further submitted that the subsequent refixation of pay and the recovery of the excess amount of Rs. 1,75,274/- was well justified as the said amount constituted public money. The respondents argued that the petitioner cannot be permitted to retain an amount beyond his entitlement.

Findings of the Court It was observed by the court that the petitioner had retired from service upon attaining the age of superannuation on 31.07.2016. The judgment in State of Punjab and others vs Rafiq Masih and others was relied upon wherein it was held by the Supreme Court that recovery cannot be made from a retired employee where payments have mistakenly been made by the employer, in excess of their entitlement.

It was further observed that there was no allegation of any misrepresentation or fraud on the part of the petitioner in the initial fixation of his pay. The Supreme Court's judgment in Thomas Daniel vs. State of Kerala was also relied upon which held that if an excess payment is made by the employer due to a mistake without any fault of the employee, such an amount cannot be recovered. It was noted by the court that the equity jurisdiction of the court is exercised to relieve an employee from the hardship of recovery in such circumstances.

It was further held by the court that if an employee had knowledge that the payment received was in excess of what was due or wrongly paid, or in cases where error is detected or corrected within a short time of wrong payment, then the courts may on the facts and circumstances of any particular case order for recovery of amount paid in excess. It was observed by the court that the employee retired from service when his pay was revised and the recovery was made from him. It was held that there was no misrepresentation or fraud on the part of the petitioner in fixation of his salary, which was re-fixed after his retirement, therefore, the excess amount paid to him during service period could not be recovered. It was further held that any recovery made from the petitioner out of his pensionary benefits was unsustainable. Therefore, it was set aside. Further it was directed by the court that the sum of Rs.1,75,274/- recovered from the petitioner be refunded to him within a period of eight weeks. With the aforesaid observations and directions, the writ petition filed by the petitioner employee was disposed of by the court. Case Name : Virender Pal vs. Union of India and Ors. Case No. : CWP-13301-2021 Counsel for the Petitioner : R.S. Sangwan, Advocate Counsel for the Respondents : Arvind Seth, Senior Panel Counsel

Dear respected pensioners,

Today, I had a discussion with the CEPT authorities regarding the DR modification in the IT 2.0 application. They have assured that the issue will be resolved by this evening.

Accordingly, the DA arrears can be disbursed by the DDOs tomorrow.

With regards,

Sivaji Vasireddy

SG, FNPO

15/10/2025

📢 Dear All,It is to intimate that Postinfo App is now discontinued by the Department. Now Dak Sewa Application is the official mobile app of Department of Posts.

📲 Download Link:

https://play.google.com/store/apps/details?id=info.indiapost.daksewa

--- Dak Sewa — the citizen-centric Android Mobile Application of Department of Posts, developed by Centre for Excellence in Postal Technology (CEPT).

This app provides the following facilities:

1️⃣ Tracking

2️⃣ Post Office Search

3️⃣ Postage Calculator

4️⃣ Complaints Management

5️⃣ Insurance Premium Calculator

6️⃣ Interest Calculator

---

🔹 TRACKING:

Facility available for: Speed Post, Registered Letter, Insured Letter, VPL, IVPL, Registered Packets, Registered Periodicals, Registered/Insured Parcels, VPP, IVPP, Business Parcel ,Business Parcel COD & e-MO.

👉 Enter Article Number and tap Track to view status.

---

🔹 POST OFFICE SEARCH:

Search by Post Office name or PIN Code.

Get details like Name, Address, Contact details, Division, etc. Also features:

✅ Nearest Post Office

✅ Locate on Google Map

✅ Direct Call to Post Office

---

🔹 POSTAGE CALCULATOR:

Calculates tariff based on weight for: Ordinary/Registered Letters, Parcels, Book Packets, Speed Post, etc. Speed Post tariff is based on distance slabs: Local, up to 200 KM, 201–1000 KM, 1001–2000 KM, and above 2000 KM.

---

🔹 COMPLAINTS MANAGEMENT:

Register, Track and get Alerts on Complaint Status at every stage.

--- 🔹 PREMIUM CALCULATOR:

Check premium payable for PLI and RPLI policies based on user input.

--- 🔹 INTEREST CALCULATOR:

Covers all Small Savings Schemes:

• Sukanya Samriddhi Yojana

• Recurring Deposit

• Time Deposit (1, 2, 3, 5 years)

• Monthly Income Scheme

• Senior Citizen Savings Scheme

• National Savings Certificate

• Kisan Vikas Patra

• MSSC

---

📱 Download & Explore Dak Sewa App – Your Digital Post Office Companion!

Constitution of Ad-hoc Committee for NAPE Group C, HAryana Circle.

Guidelines to regulate transfer under Rule 38 of Group ‘C’ and Group ‘B’ (Non-gazetted) employees in Department of Posts.

Promotions and postings in Junior Timr Sclae(JTS).

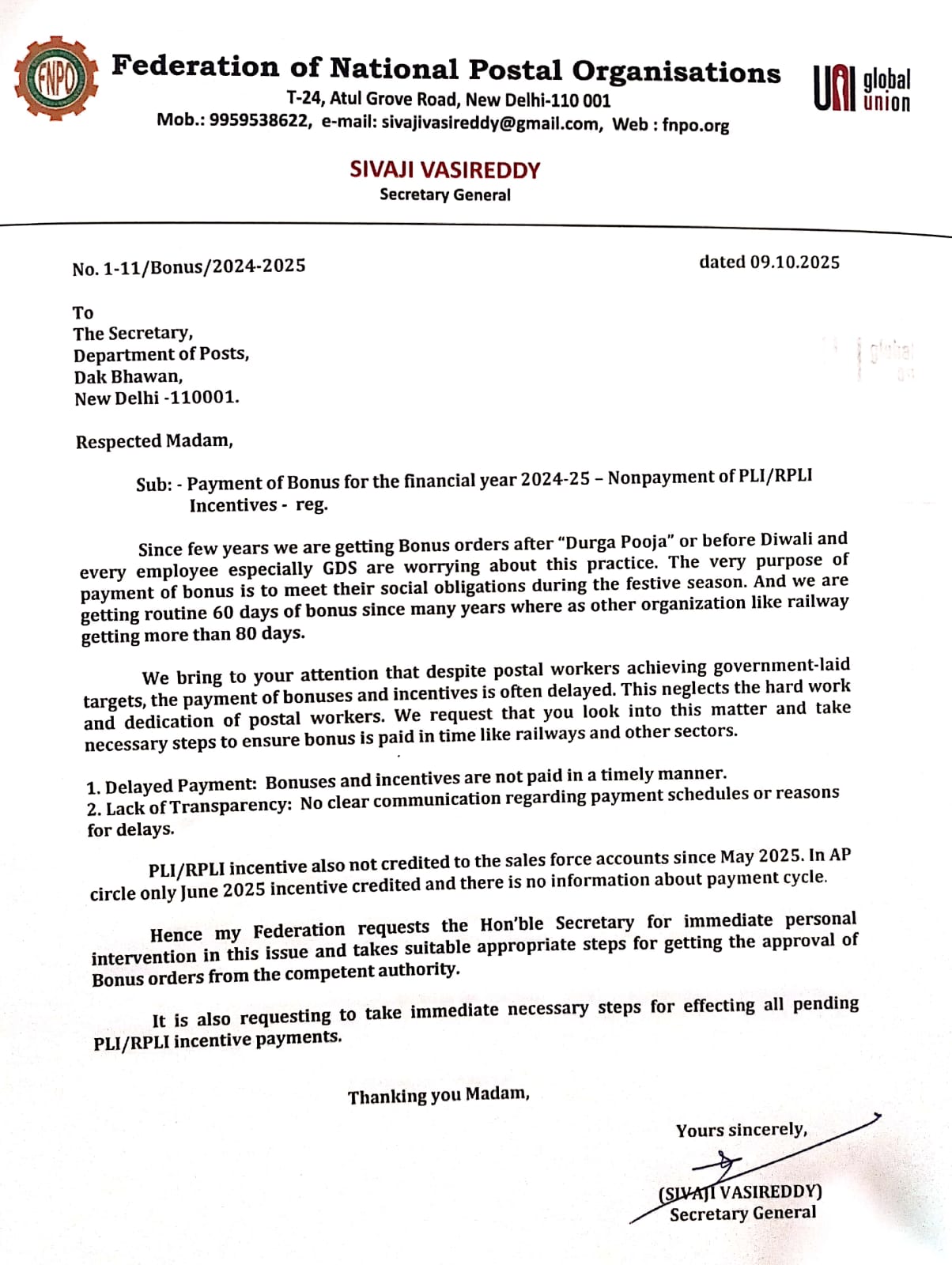

📢Update on Bonus File

The bonus file has been received today at the Directorate from the Finance Ministry. The final approval process by the Secretary (Posts) is currently underway. The official order is expected to be issued this evening or by tomorrow, as per reliable sources from the DG office.

– Sivaji Vasireddy, SG FNPO

14/10/2025

Migration to TMS 2.0 and implementation of revised CGHS Rates (effective from 00:00 Hours 13-10-2025) - Instructions to Pensioner beneficiaries who are eligible for credit.

Dear all,- The bonus file is still pending at the Department of Expenditure (DoE). Officers from the Department of Posts (DoP) have assured that orders will be issued only on Thursday or Friday. Payment can be expected on Saturday.

- Some union representatives circulated incorrect information yesterday stating that the file had been cleared by DoE and orders might be released today. Please note that this information is incorrect. Genuine updates will be communicated to all of you.

- There's no need to panic; the delay is occurring due to office shifting work at DoE.

Sivaji Vasireddy,

Secretary General, FNPO

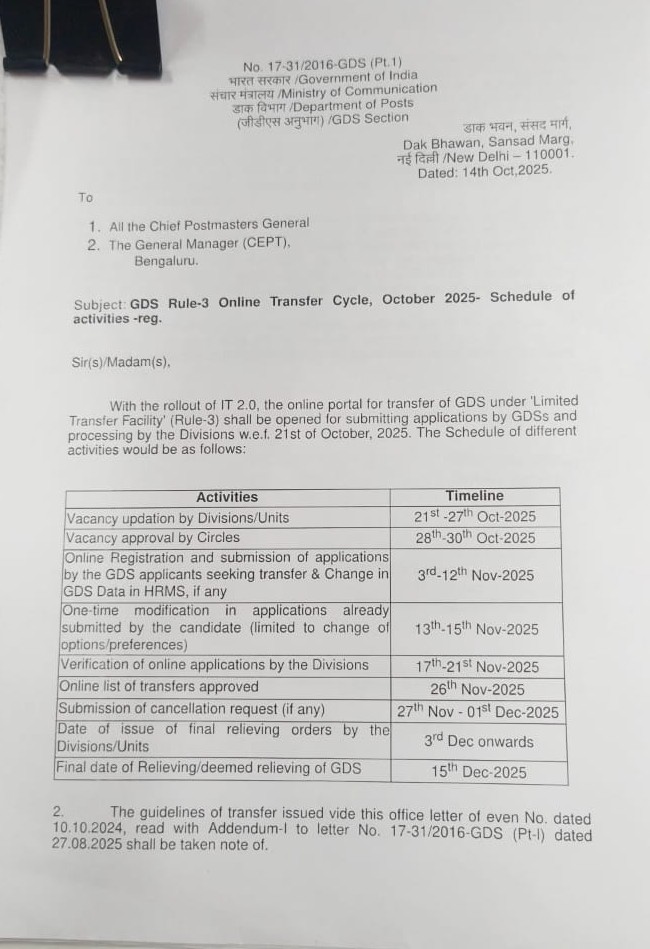

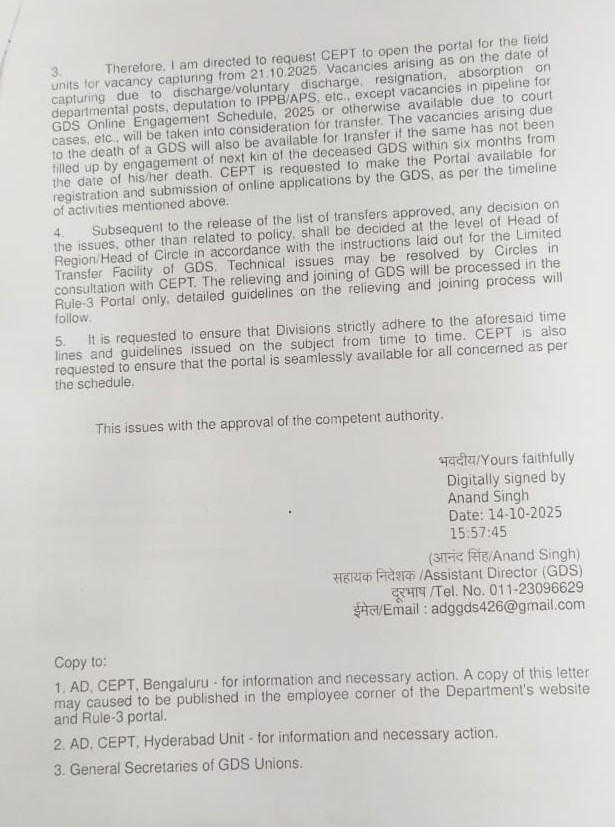

GDS Rule-3 Online Transfer Cycle, October 2025- Schedule of activities -reg

Posting of officials to the CEPT units

Click here to see the Hindi Version of this website .

“Forward ever, backward never: onwards with Breaking Through”

Affiliated union websites:

National Association of Postal Employees Group 'C

Sivaji Vasireddy

Secretary General, FNPO

sivajivasireddy@gmail.com

9959538622

13/10/2025

Provision for correction/ editing details in CCE portal (IT 1.0) reg.

ACCOUNTING OF TDS AT POST OFFICES IN APT( IT 2.0 )

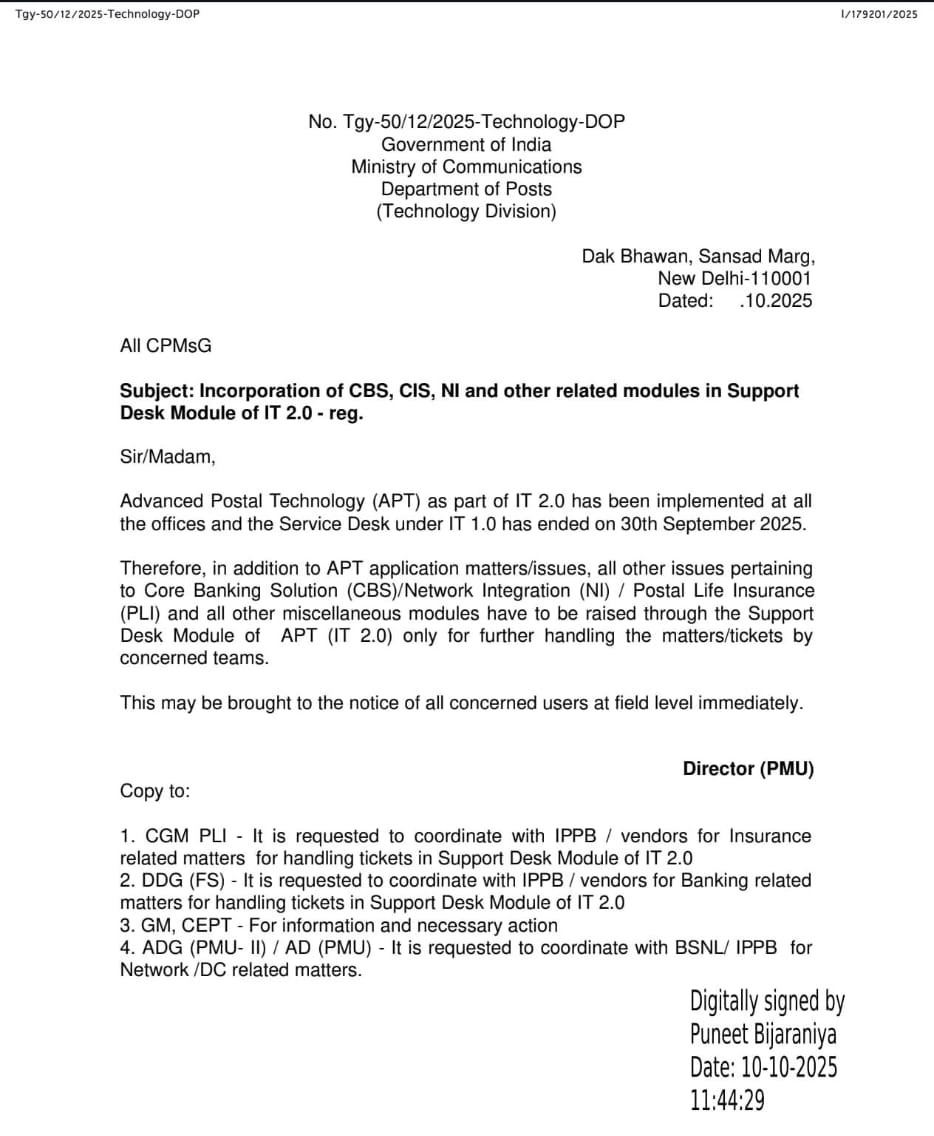

10/10/2025

DA order for GDS.

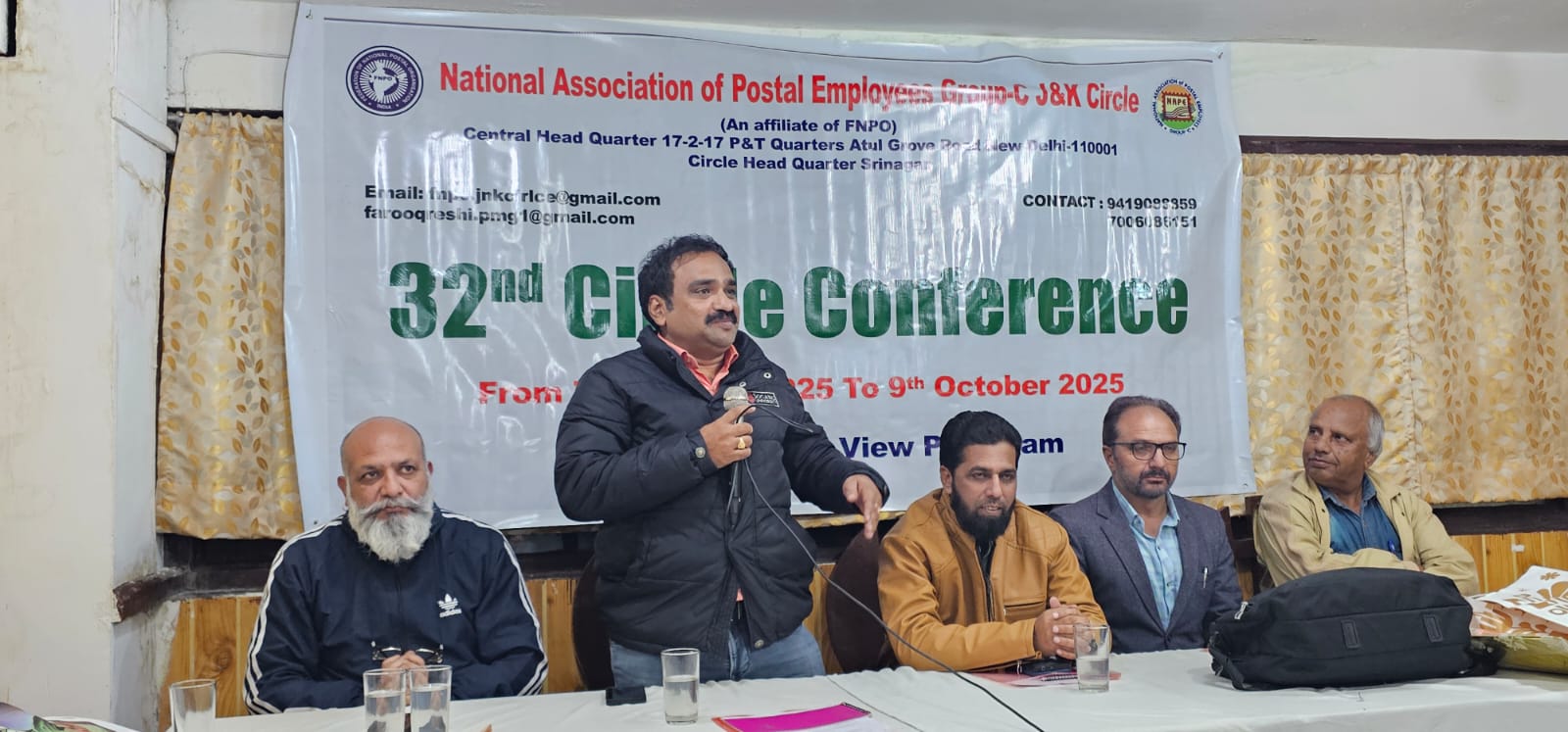

Dear all,32nd bi-ennial conference of NAPEc FNPO J&K circle conference was held at Hotel Hill view, Pahalgam from 7.10.25 to 9.10.25 under the chairmanship of Sri Kewal Chandra Sharma. Sri Sivaji Vasireddy SG FNPO/ GS NAPE c, Sri Nisar Mujawar GS NUPE PM/MTS and Sri FA Reshi AGS NAPEc CHQ were attended as guests addresses the conference. Many delegates attended from all the divisions and discussed various issues pertaining to the postal staff. AD from Srinagar CO attended as an observer for elections. During the elections Sri Kewal Chandra Sharma, Sri FA Reshi, Sri Mujaffar Ah. Mir, Sri Qazi kyser were elected unanimously as Circle President, Circle Secretary, Deputy CS, and Circle Treasurer respectively. The reception committee had provided delicious food and good accommodation for all the guests and delegates/visitors. FNPO and NAPEc extend best wishes to the newly elected J&K circle NAPEc office bearers.

With regards,

Sivaji Vasireddy

SG FNPO

GS NAPE c

09/10/2025

ENGAGEMENT OF GRAMIN DAK SEVAK FROM DEPARTMENT OF POSTS TO IPPB AS EXECUTIVE

Release of an additional installment of Dearness Relief (DR) to Central Govt. Pensioners/Family Pensioners revised rate with effective from 01.07.2025-reg.

07/10/2025

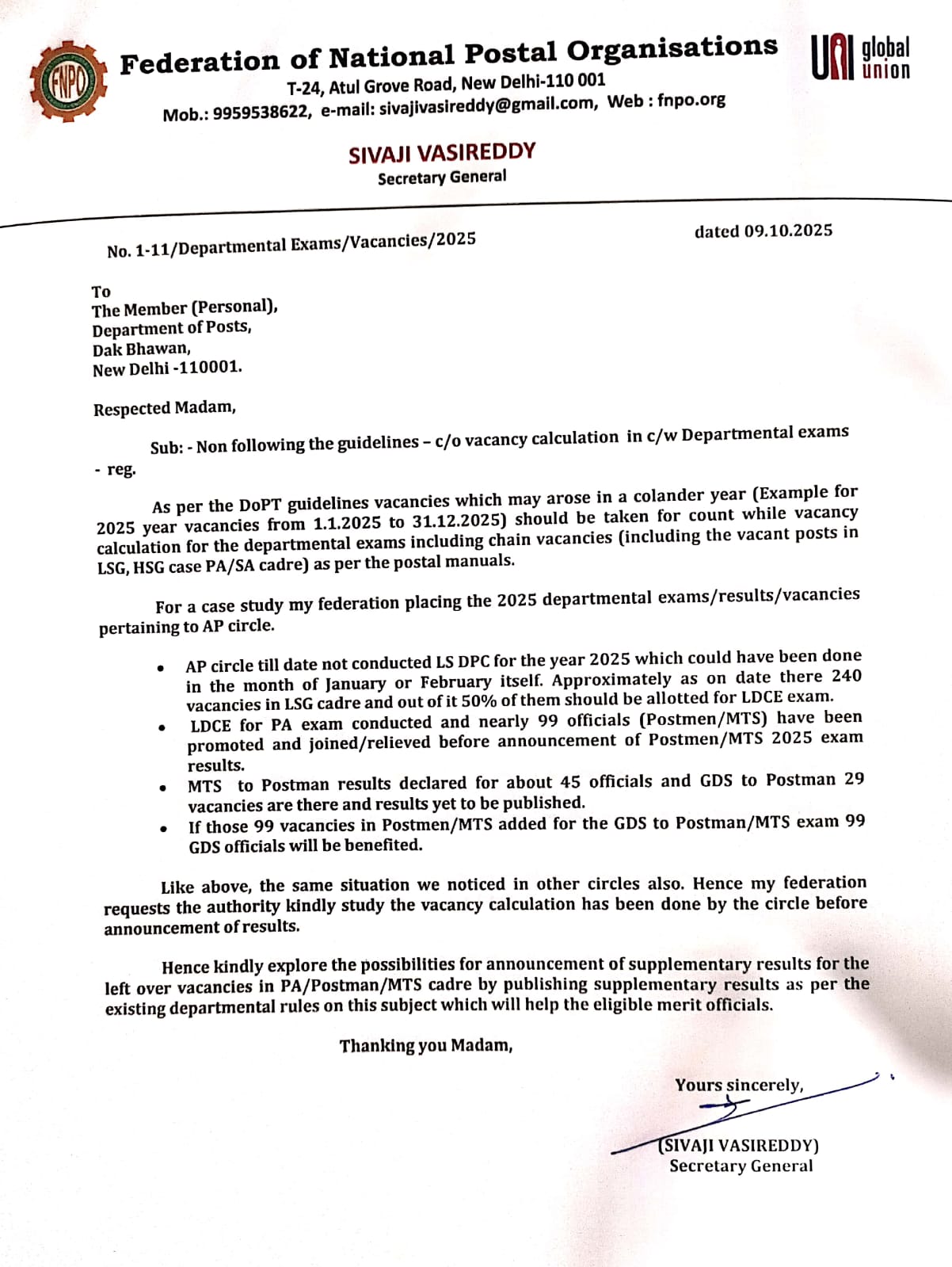

Dear all,On 6.10.2025 Sivaji Vasireddy SG FNPO & GS NAPEc, Nisar Mujawar GS NUPE PM& MTS, Prerit Kumar AGS NAPEc& CS Bihar, MK Sharma GS NUR4, Manoj Kaushik FS NAPEc met Member P, Member O, DDG P/Estt, Director GDS and DPS HQ Delhi Circle and discussed various issues and outcome of the meeting is as follow.

1. Bonus File still at DoE and given assurance to release order as soon as possible and DoP officer will pay a visit to DoE if needed.

2. Rule 38 for Department employees and Rule 3 for GDS Portal will be enabled in this month itself.

3. Chain vacancies (Vacant posts in LSG, HSG and notified PA posts for current exam and resulting Postman& MTS posts) not taken into account for PA, Postman/MTS posts by almost all circles and which resulted injustice to qualified candidates in the last exams. To avoid this a case study will be done soon from 3 to 4 circles about calculation of vacancies.

4. Delhi spl recruitment 2022 MTS surplus/2nd list result going to declare within 10 days.

5. Delhi Spl recruitment 2023 postman MTS results case....circles have been given time upto 12.10.2025 to delete the names from 2023 eligible list those who selected for 2022 vacancies already. After receipt of same from all circles final scrutiny will be done and results will be published. Every one should join before 31.12.25 only for not to lose increment and exam eligibility and FNPO is trying for that.

6. In Delhi quarters allotment issue... ../assets between postal and BSNL distribution is in speed way and after that allotments for staff will be given.

7. Leave vacancies substitute case of Delhi postman issue also discussed and assured to resolve soon.

8. Ex-servicemen pay fixation issue information from circles pending and FNPO also asked to resolve the issue of Postman staff (ex-servicemen) pay fixation issue who appointed from open market.

9. Accounts line cadre merger order dated 11.2.25 should be withdrawn and commom RR should be introduced.

10. IDC related all problems discussed and positive assurance given.

11. Very soon Postman cadre review committe will held meeting with Unions.

12. FNPO strongly defended the need to provide sorting postman posts at IDCs.

13. West Bengal, Gujrat and Bihar circle transfers issues also discussed and received positive respons.

14. Requested to take action for issue of orders case of One-time relaxation for HSGII and HSG I promotions.

Remaining issues(Like closure of POs and IT 2.o) and other updates will be given during my next visit to Directorate on 9.10.25.

Sivaji Vasireddy, SG FNPO

05/10/2025

Sri K.Rama Moorthy, The Legendary Personality in Indian Posts & Telegraph Movement.

Sri K.Rama Moorthy, The Legendary Personality in Indian Posts & Telegraph Movement.Today our FNPO founder and visionary leader was the late Sri K.Ramamurthy's 31st death(5.10.1995) anniversary. He faught for workers and for democracy till the last breath. We should follow the way shown by him forever. It is pertinent to remember about the services rendered for the welfare of GDS especially extension of DA to GDS.

Sri K Rammmurthy not only founder of FNPO he is a honest and sincere Leader. We should remember one incident, during 1960 Strike period several officials suspended including KR. The department revoke suspended order and asked him to join duty but he refused. He didn't joined duty till issue of last suspended person revoke order.

That is KR. K.R was of the view that youngsters should be encouraged to get early promotions by way of conducting competitive exams. He felt that the supervisior posts in the department require some skill and competence in the new technology era and introduced new services. Even in the Trade union movement he urged youth to come forward to take the leadership and encouraged them by deputing to various Trade Union seminars conducted in India and Foreign also. This is the greatest vision of our beloved KR.

His life was sacrificed to defend postal workers and postal services. He didn't care about his family and but he always thinks about total P&T employees.

To remember a great personality on the eve of death anniversary is a real privilege. We are facing extremely difficult situation, but we will climb up from this crisis. We should proud for serving in postal department and also proud for working for postal workers , whom KR loved and sacrificed.

I pay respectful homage to legendary lear KR. 💐💐👏

FNPO Zindabad..

K R Amar Rahe

Sivaji Vasireddy

GS NAPEc FNPO

04/10/2025

Introduction of Continuous Clearing and Settlement on Realisation in Cheque Truncation System .

Dear all, from today onwards, continuous cheque clearing process is implemented. Accordingly, the cheques will be cleared and credited in the accounts on the same day. HOs should scan the cheques (received for credits in POSB schemes) for clearing as and when received. Scanning should be completed before 1400 Hrs.Please pass on this message to the HOs. - Thank you

01/10/2025

Grant of offiçiating arrangement and pay and allowançes to selection grade posts by implementing the Postal Directorate instructions dated 28.07.2011.

Today Cabinet approves 3%DA Hike for CG employees wef 1.7.25

Today Cabinet approves 3%DA Hike for CG employees wef 1.7.25

FNPO

T-24, ATUL GROVE ROAD

NEW DELHI 110 001

India

ph: 011- 23321378